MARCH 2023 | SANTA BARBARA REAL ESTATE UPDATE

- Mar 27, 2023

- By Jon-Ryan Schlobohm

- In Uncategorized

- 0 Comments

2023 is off, running, & WET!!! We have been checking the rain totals all too often on this website (VIEW WEBSITE). Enough about rain, really we are ready for some sun, and hopefully, this is the last storm. Here is the latest Santa Barbara real estate market news.

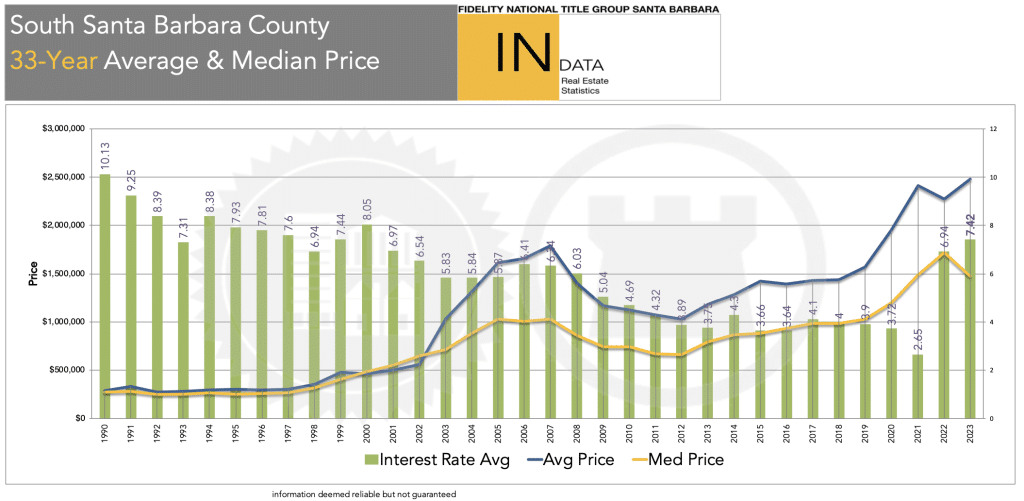

The main headline remains, sales volume continues to stay low. Comparing it to our more historically normal years our sales volume is down around 35% year-to-date continuing the trend that we experienced in the second half of 2022.

There are a number of reasons for the notable decrease in sales:

First, the number of active listings continues to stay remarkably low. On March 14, between Carpinteria to Goleta, we only had 129 homes and condos for sale at all price points. For perspective, our inventory historically would drop to around 250 at the end of a calendar year. When this would happen we consider that low inventory, and traditionally, it would bounce back up quickly.

Second, interest rates have increased so much which is affecting both buyers and sellers. For buyers, it is simply costing them much more to buy a home. For sellers, it is a little bit like a pair of handcuffs. Many sellers are locked into a low-interest rate thankfully, but giving up that loan and rate for something twice as expensive has cooled the idea of selling for many.

But not to be missed, even with interest rates doubling, home ownership is still very appealing and we have more buyers in the market than sellers. As Realtors, we are all networking in our search for homes for our clients. A few days ago, we received an email from a fellow agent with a list of 20 different homes she is looking for for clients. This is an extreme, but there are many buyers in the market looking for homes.

Over, the last couple months, there have been a couple surprising facts.

With interest rates rising and sales volume dropping we expected more of our transactions to be cash purchases proportionally, but at a quick glance sales show that it continues to follow more or less our historic norms. The balance of cash & financed purchases is normal, cash sales are not proportionally higher.

The second surprise has been the sale prices some homes are garnering. We have seen a handful of properties with ambitious list prices going under contract quickly. In addition, we are still hearing about multiple offers and some properties getting bid up. Overall prices seem to be stabilizing.

As always, real estate is dynamic and it is important to have a knowledgable and caring advisor to help you through the process. If you are considering buying or selling, we would be honored to help. And we are always grateful for your recommendation!

THE HIGH & LOW

February 2023 Highest Sale | 751 Buena Vista Dr, Montecito | Sold for $17,500,000

February 2023 Lowest Home Sale | 1o S Alisos St, Santa Barbara | Sold for $835,000

The Statistics

YTD | Jan-Feb 2023

- Total Sales: 142 in ’23 vs 236 in ’22 | DOWN 40%

- Total Home Sales: 101 in ’23 vs 168 in ’22 | DOWN 40%

- Total Condo Sales: 41 in ’23 vs 68 in ’22 | DOWN 39%

- Median Home Price: $1,95,000 in ’23 vs $2,207,000 in ’22 | DOWN 12%

- Median Condo Price: $925,000 in ’23 vs $875,000 in ’22 | UP 6%

- Sales Above $5M: 17 in ’23 vs 23 in ’22 | DOWN 23%

February 2023

- Total Sales: 73 in ’23 vs 129 in ’22 | DOWN 43%

- Pending Sales: 88 in ’23 vs 132 in ’21 | DOWN 33%

- Total Off-Market Sales: 9 Sales | 12%

- Total Cash Sales: 24 Sales | 33%

- Average 30-Year Fixed Rate Mortgage: 6.67% as of March 20, ’23